Gifts of Real Estate

Avoid capital gains tax and redirect funds to charity through a partial sale/partial gift of real estate.

It is not new for the church to need funds to meet financial needs. Even the church in Acts had financial needs among them. One way the apostles received funds to meet these needs was through the sale of land and houses owned by believers.

“. . . For as many as were possessors of lands or houses sold them and brought the prices of the things that were sold . . . Barnabas . . . having land, sold it, and brought the money and laid it at the apostles’ feet.” -Acts 4:34-37

Some Things to Remember:

Donations of cash or non-appreciated property may be deductible up to 60 percent of the donor’s adjusted gross income (AGI). But with donations of appreciated property such as real estate, the deduction is limited to 30 percent of AGI. However, if the deduction from a donation exceeds the amount which the donor can deduct in one year, the balance of the deduction can be carried forward an additional five years and used to offset taxes in subsequent years.

Even though a property has appreciated in value, it must have been owned for one year or longer in order for the appreciation to be taxed as capital gain. Otherwise, the tax deduction will be for the cost basis in the property rather than its fair market value.

Other types of property, such as stocks, bonds, mutual funds, and certain tangible personal property, may also be donated to offset capital gains tax in the same way.

Property must be debt-free to be donated in this way.

Property must be free from environmental contamination or other encumbrances.

Property subject to a written sales agreement cannot be donated in this way. Because the property is under contractual obligation, it can no longer be a gift that the donor relinquishes control over.

Properly planning a partial-sale/partial-gift transaction of real estate generally takes a minimum of 60 days. During this process, Anabaptist Foundation works closely with the donor’s legal counsel and tax advisor to generate a tax deduction that meets the donor’s objectives.

Example:

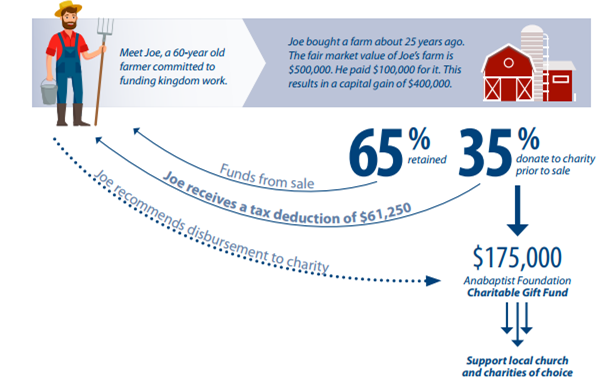

Meet Joe, a 60-year-old farmer committed to helping his church and funding the work of God’s kingdom. Joe bought a farm about 25 years ago. Now his children are grown and have all left home, and Joe and his wife want to sell the farm and move to a smaller place.

Joe knows he has several options. He can sell the property and make a cash donation from the proceeds. The fair market value of Joe’s farm is $500,000. He paid $100,000 for it. This results in a capital gain of $400,000. While Joe has tithed regularly on the income earned each year on the farm, he also wishes to give 10 percent, or $40,000 of this gain to charity.

Joe’s combined federal and state tax bracket is 22 percent, which results in a capital gains tax liability of $88,000 when he sells the farm. After paying his capital gains tax and giving 10 percent of the gain, he has a net of $372,000 left over in the bank.

Another option is to donate a portion of his property to Anabaptist Foundation prior to the sale. If Joe and his wife donate 35 percent of their farm to Anabaptist Foundation prior to the sale, they reduce their capital gain from $400,000 to $260,000 and capital gains tax liability from $88,000 to $57,200. By making this donation, they receive a charitable deduction of $175,000—the fair market value of their gift to charity—resulting in a tax deduction of $61,250, based on his tax rates.

This tax deduction more than offsets the $57,200 capital gains tax on the sale of the farm. Joe and his wife end up with $329,050 before income taxes, rather than $372,000, but they are blessed by having redirected a substantial amount of dollars to their church and charities they support. While they have $42,950 less in proceeds from the sale, they have been able to leverage their giving and fund the Lord’s work by an additional $135,000.

How can real estate be donated to Anabaptist Foundation?

Contact Anabaptist Foundation

To learn more, contact Anabaptist Foundation at (800) 653-9817 before you make a sales agreement or enter a verbal understanding. Individual situations and tax brackets vary, producing different results.

Review Your Situation

Foundation staff will review your situation and provide a non-specific calculation of the donation that would offset your capital gains taxes. You must rely on your accountant and tax advisor to plan the specific tax effect of your donation to Anabaptist Foundation.

Make Your Gift

You are under no obligation to make a gift to charity by making an inquiry. Anabaptist Foundation is a neutral intermediary with no programs of our own for which we raise funds. After we deduct direct expenses and a nominal fee, all funds are distributed to the church and charities of the donor’s choice.

NOTICE: This article has been prepared for educational and informational purposes only. It is not legal advice nor legal opinions on any specific matters. You will need an attorney from your state to draft and execute your documents. You should seek the counsel of your accountant or tax advisor.